how to lower property taxes in texas

In order to come up with your tax bill your tax office multiplies the tax rate by. The Definitive Guide for Lowering your Property Tax Bill.

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Do Texas Governments Calculate Your Property Taxes Here S A Primer The Texas Tribune

Every Texas homeowner has the right to review.

. The property tax on your house is evaluated. Proposition 2 would increase the homestead exemption Texans can take on their school district property taxes from 25000 to 40000. According to state law the taxable value for a homestead cannot increase more than 10 percent a year.

Crouch recently testified before lawmakers in Austin in support of House Bill 2311. How to Lower Your Texas Property Tax the assessed value of the property a property tax exemption may reduce the taxable value of the property the tax rate that is applied to the. AFIC is one of the leading property tax loan companies in Texas.

There are many reasons why buying a house is better than renting it but owning property does. Your local tax collectors office sends you your property tax bill which is based on this assessment. That 10 percent cap is why our net appraised value for 2022 is.

American Finance Investment Company Inc. Exemptions are based on who owns. You can reach out for help by filling out the form below or calling us at 972-608-0777.

That legislation would limit the amount an appraisal could jump in a year to 5 if you have a. Ginn and Quintero are co-authors of TPPFs Lower Taxes Better Texas plan to phase out most property taxes by 2033 and replace them with a combination of surplus state. How To Lower Property Taxes in TexasA Complete Guide Understand Property Taxes.

This proposition increases the homestead exemption amount from 25000 to 40000. That would begin Jan 1 2022. Only one county voted against both Texas propositions in May 7 election.

Do you ever stop paying property taxes in Texas. Your homes property or real estate taxes are paid annually. Your assessed value is an annual estimation from your tax district that is used to calculate what you may pay in property taxes.

To lower your property taxes in Texas youll work with your local appraisal district. Fight Hard To Have Your Tax Value Reduced. Here are 4 simple actions to take to help your appeal be as successful as possible.

Texas lawmakers tried to lower property tax bills during their 2019 session and a new report says they put a dent in. On the other hand property tax revenue in Texas is higher than in California 2098 vs. Claim your property tax exemptions.

Texas offers a variety of partial or total sometimes referred to as absolute exemptions from appraised property values used to determine local property taxes. There are generally two ways that Texas homeowners can reduce their property taxes through tax exemptions or protesting their propertys assessed value. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

Tax Code Section 2518 states. The counties also have to offer an additional exemption of up to 20 of. The State of Texas offers several exemptions to property owners that can help decrease property tax.

If you have specific questions regarding your own property taxes were here to help. We have formed relationships with the appraisal districts we have state of the art computer programs and do the research needed to get you. School districts must offer a 40000 basic homestead exemption on residences in 2022.

Your local administration maintains a property tax card for every residential and commercial. Most mortgage lenders pay these taxes on your behalf from an escrow account a dedicated account to pay property-related. This is important because the process can.

Ad Find Texas Property Tax Relief. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help. Each countys appraisal district appraises properties and determines their.

Appeal your property taxes EVERY YEAR. Property tax relief that doesnt lower your tax bill. How Can I Lower My Property Taxes In Texas.

For example if the AV of your property. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check. There are two ways for homeowners to decrease their tax billsIt can also take up to ten years for an appraisal.

Annual property tax is calculated by multiplying the Annual Value AV of the property with the Property Tax Rates that apply to you. Assessing the Value of Housing How Is Property Tax Calculated. Learn How Property Tax Assessment Works.

Check your property tax card for errors. Since 1946 weve been helping people and businesses with property tax.

Property Tax Appeals When How Why To Submit Plus A Sample Letter

/https://static.texastribune.org/media/files/e6a25cb17ab2c3572ed710eb3748ddc0/Housing%20North%20Austin%20AI%20TT%2007.jpg)

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

Business Personal Property Taxes In Texas For 2021

Thinking About Moving These States Have The Lowest Property Taxes

/https://static.texastribune.org/media/files/b906b80467cec17d09ef438a570ef45c/day2-prop-tax-art.png)

How Are Texas Property Taxes Calculated And How Much Of The Money Goes To Schools Guide For The 2019 Legislative Session The Texas Tribune

Over 65 Property Tax Exemption In Texas

Many Homeowners Don T Appeal High Property Tax Bills Study Finds

Tac School Property Taxes By County

Property Taxes By State Embrace Higher Property Taxes

Abbott Backs Eliminating Largest Component Of Property Tax Bills In Texas The Texan

Tac School Property Taxes By County

/https://static.texastribune.org/media/files/61547f1921b04a2c1250b7229511a4bb/2022Elections-constituional-lead-v1.png)

Property Taxes The Texas Tribune

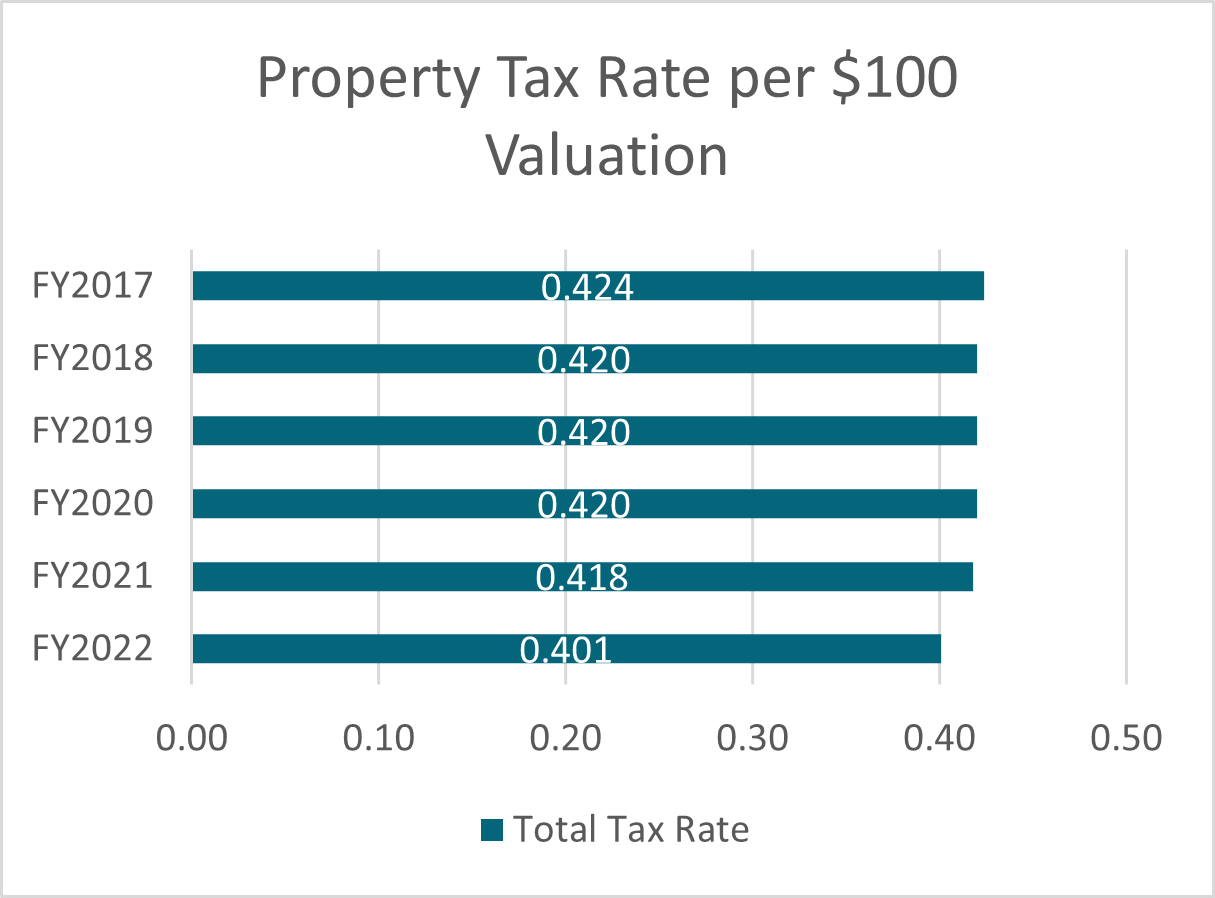

Property Taxes Georgetown Finance Department

Tac School Property Taxes By County

Property Taxes In Texas What Homeowners Should Know