irs unemployment tax break refund update

4th STIMULUS CHECK. 22 2022 Published 742 am.

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Taxpayers should not have been.

. When To Expect Unemployment Tax. More than 10 million people who lost work in 2020 and filed. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers.

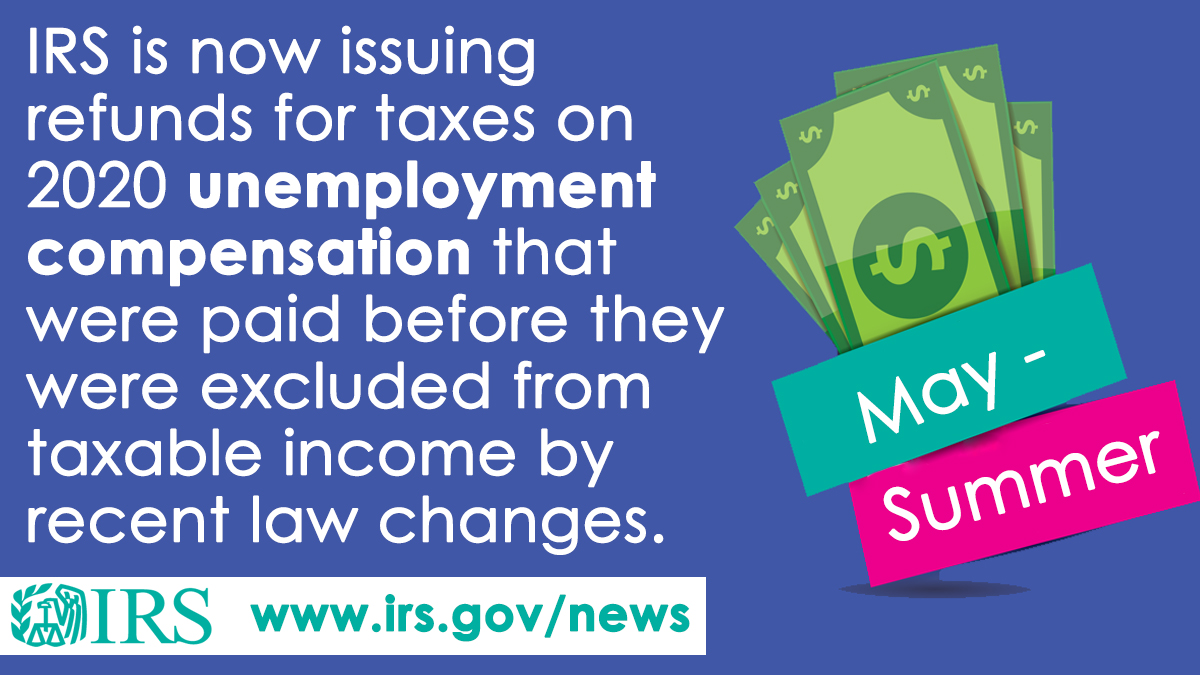

Last year the government imposed no taxes on those who received up to 10200 of benefits in 2020 as part of the COVID-19 relief law the American Rescue Plan Act. IR-2021-159 July 28 2021. Irs Sends 430000 Additional Tax Refunds Over Unemployment Benefits.

IRS tax refunds to start in May for 10200 unemployment tax break. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who.

Single taxpayers who lost work in 2020 could see extra refund money soonest. Initially we all thought they would be automatically applying the tax break and we would get our checks or direct deposit all. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in.

The IRS just posted an update about the tax break. Updated March 23 2022 A1. IR-2021-212 November 1 2021.

Unemployment refunds are scheduled to be processed in two separate waves. Unemployment 10200 tax break. The first wave will recalculate taxes owed by taxpayers who are eligible to exclude up to 10200.

By Anuradha Garg. In the latest batch of refunds announced in November however. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns.

Heres what you need to know Jessica Menton USA TODAY April 1 2021 1136 AM 4 min read. 1 the IRS has now issued more than 117 million unemployment compensation refunds totaling over. Nine Important Things To Know About The Unemployment Tax Break Irs Refunds 10200 IRS UNEMPLOYMENT TAX refund update.

These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. Irs unemployment tax refund august update.

All of the federal taxes withheld will be reported on the 2021 return as a tax payment. The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144. Billion for tax year 2020.

The irs is recalculating refunds for people. The Internal Revenue Service is delivering a fourth round of special tax refunds this. Nine Important Things To Know About The Unemployment Tax Break Irs Refunds.

IRS schedule for unemployment tax refunds With the latest batch of payments on Nov. Will I receive a 10200 refund. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit.

The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. The IRS previously issued refunds related to unemployment compensation exclusion in May and June and it will continue to issue refunds throughout the summer. The agency had sent more than 117 million refunds worth 144.

2nd wave refund arrival 10200 unemployment tax refund unemployment update 06082021 The IRS has only provided limited information on its website about. Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com Interesting Update On The Unemployment Refund R Irs. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

14 4 Billion Worth Of Tax Refunds Finally Given To Eligible Taxpayers Irs To Distribute 1 600 Refunds Each Before The Year Ends The Republic Monitor

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Irs Tax Refund Delays Persist For Months For Some Americans Abc11 Raleigh Durham

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Unemployment Tax Refunds May Not Arrive Until Next Year Warns Irs

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

The Irs Can Seize Your Unemployment Tax Refund For These Reasons

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Irsnews On Twitter Irs Is Issuing Refunds For Taxes Paid On 2020 Unemployment Compensation Excluded From Income The First Adjustments Are For Single Taxpayers Who Had The Simplest Tax Returns Details At

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time